by Aude Camus

The entrepreneurs of Hong Kong series is one of our most popular interview series on Hong Kong Madame and we are delighted to see that, just like us, you seem to love hearing about inspiring stories and passionate entrepreneurs who are contributing to make Hong Kong the buzzing city that we know. But one thing I have noticed is that, over the year, I’ve tended to focus my interviews and bringing the spotlight on those working in what we (or maybe just I) consider as “cool” industries such as the FnB or the Fashion sectors. But Hong Kong is way more than just a vibrant dining scene and a city of luxury brands, it is a city that encourages entrepreneur to thrive no matter which industry they work in and my aim, this year, is to meet and interview more of those passionate individuals who are successful in what they do even though it might not be the most glamourous activity.

Take accounting … I imagine many of the entrepreneurs I have interviewed before could testify that finding the right person, someone that is efficient and who you can trust, is crucial. Being an entrepreneur myself, I find delegating those services to someone not only convenient but also a great way to save time and money. So, here’s to more stories from local entrepreneurs with Raymond Lam, founder of K.F.Lam & Co - Certified Public Accountants (Practising)

Hi Raymond. Thanks so much for taking the time to answer a few questions. I imagine the beginning of a new year must be busy for you with your clients closing their financial year. Can you quickly introduce yourself and what you do?

The entrepreneurs of Hong Kong series is one of our most popular interview series on Hong Kong Madame and we are delighted to see that, just like us, you seem to love hearing about inspiring stories and passionate entrepreneurs who are contributing to make Hong Kong the buzzing city that we know. But one thing I have noticed is that, over the year, I’ve tended to focus my interviews and bringing the spotlight on those working in what we (or maybe just I) consider as “cool” industries such as the FnB or the Fashion sectors. But Hong Kong is way more than just a vibrant dining scene and a city of luxury brands, it is a city that encourages entrepreneur to thrive no matter which industry they work in and my aim, this year, is to meet and interview more of those passionate individuals who are successful in what they do even though it might not be the most glamourous activity.

Take accounting … I imagine many of the entrepreneurs I have interviewed before could testify that finding the right person, someone that is efficient and who you can trust, is crucial. Being an entrepreneur myself, I find delegating those services to someone not only convenient but also a great way to save time and money. So, here’s to more stories from local entrepreneurs with Raymond Lam, founder of K.F.Lam & Co - Certified Public Accountants (Practising)

Hi Raymond. Thanks so much for taking the time to answer a few questions. I imagine the beginning of a new year must be busy for you with your clients closing their financial year. Can you quickly introduce yourself and what you do?

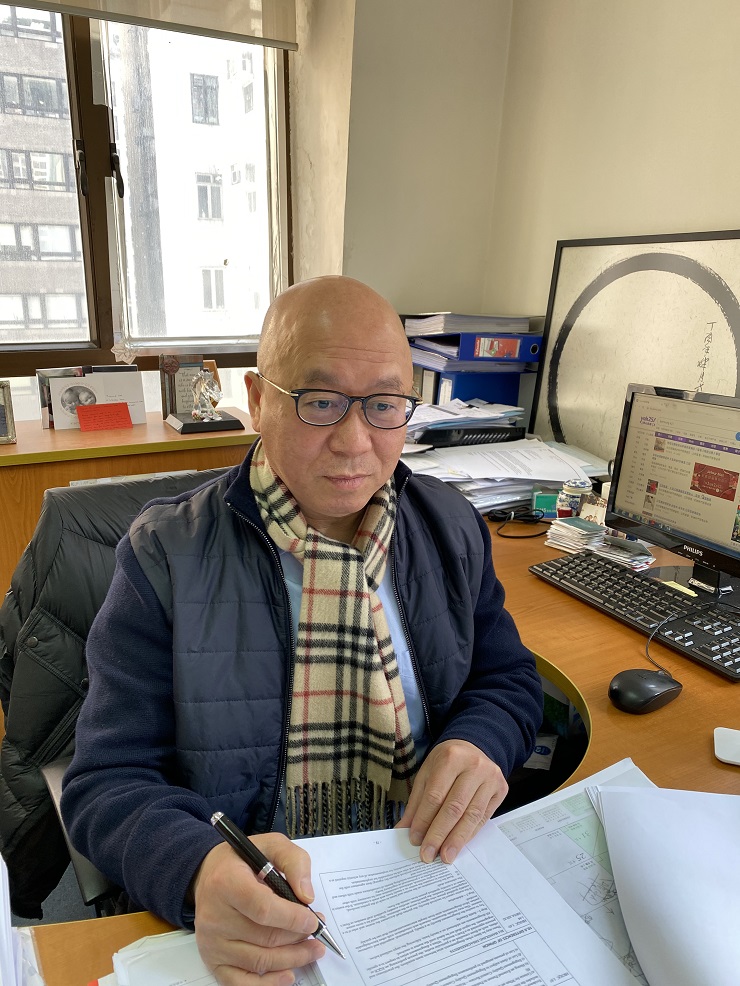

Sure. Born and raised in Hong Kong, I am a Certified Public Accountant (Practising) with more than 20 years’ experience. I started my career in the accounting field with sizable accounting firms and gained enough experience to launch my own practice K.F.Lam & Co.

I provide a broad range of services to both individuals and corporations, our main ones being taxation, audit assurance, corporate secretarial and accounting services. We also assist with working visa processes and can provide accounting reports for migration.

Who are your clients?

It is a good mix of local – 40% - and expat – 60% and mainly from Europe and the USA - people and firms. A good majority of them being trading companies sourcing products from Mainland China to sale them in their country of origin.

With more than 20 years’ experience in the field, you must have seen quite some changes over the years – be it in the type of companies and people you assist or in the kind of services you provide. Is there one service which as kind of taking over the other ones that you provide?

I have for sure seen some changes in the way I do my work and the type of people and companies I’ve been assisting over the years. Those changes have also been largely driven by the transformation of Hong Kong from a manufacturing-oriented city to a services-centered city.

I provide a broad range of services to both individuals and corporations, our main ones being taxation, audit assurance, corporate secretarial and accounting services. We also assist with working visa processes and can provide accounting reports for migration.

Who are your clients?

It is a good mix of local – 40% - and expat – 60% and mainly from Europe and the USA - people and firms. A good majority of them being trading companies sourcing products from Mainland China to sale them in their country of origin.

With more than 20 years’ experience in the field, you must have seen quite some changes over the years – be it in the type of companies and people you assist or in the kind of services you provide. Is there one service which as kind of taking over the other ones that you provide?

I have for sure seen some changes in the way I do my work and the type of people and companies I’ve been assisting over the years. Those changes have also been largely driven by the transformation of Hong Kong from a manufacturing-oriented city to a services-centered city.

When this shift happened, many foreigners saw interesting opportunities in the prosperous local economy. This is when I started to have more expat clients, looking for my local knowledge. I have also been benefiting from a good worth of mouth with for example one of my French clients introducing me to his network. Those are the reasons why one of my main focus today is to help foreigners establish and grow their business in Hong Kong.

I am a total foreigner to the world of accounting, taxation, audit … I imagine some of my readers also are. Are they any examples you can share with us on how you’ve been assisting some of your clients?

Of course. What I do is very different whether you are an individual or a corporation.

Individuals usually need my help regarding taxation issues. Let me give you this example of a French client of mine. Like you and I, he has been paying his taxes in Hong Kong. But he had no proper understanding of the Hong Kong Tax System and came to me as he felt he was paying too many taxes.

I am a total foreigner to the world of accounting, taxation, audit … I imagine some of my readers also are. Are they any examples you can share with us on how you’ve been assisting some of your clients?

Of course. What I do is very different whether you are an individual or a corporation.

Individuals usually need my help regarding taxation issues. Let me give you this example of a French client of mine. Like you and I, he has been paying his taxes in Hong Kong. But he had no proper understanding of the Hong Kong Tax System and came to me as he felt he was paying too many taxes.

And he was indeed. After studying his file, I engaged with the tax office and pleaded his case, informing them of a change of personal situation they haven’t been made aware of before which resulted in him being refunded HKD250,000 from the Inland Revenue Department (editor’s note: if this sounds too good to be true for you, I can personally testify that the same happened to a friend of mine and he was refunded around HKD70,000 so checking your taxes might be a good idea … just saying).

When it comes to corporate clients, I assist them in many ways including offshore tax planning. Offshore activities are non-taxable, but it is sometimes hard for companies to understand and explain which of their activities are offshore and which are not. Take a trading firm sourcing product from Mainland China to sale in France. Under Hong Kong Profits Tax, the sales and purchase activities of this company which are occurring outside of Hong Kong are non-taxable and it is my role to assist my client in applying to offshore tax claims. It can be very tricky as many trading companies have a mix of offshore and inshore activities.

I also think that living abroad, those clients are looking at being reassured. They are looking for someone they can trust. My style is not really to have you sign up for a package and meet you once a year for your annual audit. I believe each client has his/her needs and challenges which we can only identify, understand and address with meeting regularly and keeping close contact. Some of my clients even became family friends.

What would you say has been so far the deepest challenge running your own business in Hong Kong?

Hong Kong is a very competitive and fast-paced city where taxation and accounting requirements evolve constantly. My greatest challenge is to always keep up to date and understand what are the new and updated policies and how they could affect the unique needs of each and everyone of my clients. I have to make sure and always stay on top of the latest releases and announcements issued by the government.

And the greatest reward?

Seeing my clients’ businesses grow is very rewarding. I also like that I get to be part of an entire journey from setting up a company in Hong Kong to having an established business with a good turnover. I have been doing what I do for 20 years and some of my clients are now reaching their retirement age and transferring the business to the next generation. Seeing this new generation willing to continue working with my company is a great reward to the work I’ve done and the trust and relationship I am building with my clients.

When it comes to corporate clients, I assist them in many ways including offshore tax planning. Offshore activities are non-taxable, but it is sometimes hard for companies to understand and explain which of their activities are offshore and which are not. Take a trading firm sourcing product from Mainland China to sale in France. Under Hong Kong Profits Tax, the sales and purchase activities of this company which are occurring outside of Hong Kong are non-taxable and it is my role to assist my client in applying to offshore tax claims. It can be very tricky as many trading companies have a mix of offshore and inshore activities.

I also think that living abroad, those clients are looking at being reassured. They are looking for someone they can trust. My style is not really to have you sign up for a package and meet you once a year for your annual audit. I believe each client has his/her needs and challenges which we can only identify, understand and address with meeting regularly and keeping close contact. Some of my clients even became family friends.

What would you say has been so far the deepest challenge running your own business in Hong Kong?

Hong Kong is a very competitive and fast-paced city where taxation and accounting requirements evolve constantly. My greatest challenge is to always keep up to date and understand what are the new and updated policies and how they could affect the unique needs of each and everyone of my clients. I have to make sure and always stay on top of the latest releases and announcements issued by the government.

And the greatest reward?

Seeing my clients’ businesses grow is very rewarding. I also like that I get to be part of an entire journey from setting up a company in Hong Kong to having an established business with a good turnover. I have been doing what I do for 20 years and some of my clients are now reaching their retirement age and transferring the business to the next generation. Seeing this new generation willing to continue working with my company is a great reward to the work I’ve done and the trust and relationship I am building with my clients.

And do you see a common trend among clients who approach you, whether they are individuals or corporates?

I think the very basic common trend between most of our clients is their lack of knowledge about the local taxation system. Corporates could of course hire someone in-house but for SMEs it is a cost-effective solution to outsource their taxation advice needs.

I also understand that you have quite a few French clients. Why is that so?

I was introduced to my very first French clients 15 years ago. I have been working for him, as a consultant, for a few years and he then took me to France to assist him with taxes and auditing for one of his company. It was my first time in your country and also an eye-opening experience which gave me a better understanding of the French culture, especially at work. So I have this background of having worked in France, which I believe is not so common to find in a local accounting firm. And the French community in Hong Kong is such a tight-knit one that having this client talked about my services to his friends has helped me gained a few more clients and so on. The word-of-mouth has been working pretty well for me and I believe my French clients are happy to work with someone who understand their needs and culture even though there is no French speaker in our team.

Raymond Lam

raymond@libration.com.hk

+852 3118 2261

K.F.LAM & Co

Certified Public Accountants (Practising)

Unit 3, 10/F, Arion Commercial Centre

2-12 Queen’s Road West

Sheung Wan

raymond@libration.com.hk

+852 3118 2261

K.F.LAM & Co

Certified Public Accountants (Practising)

Unit 3, 10/F, Arion Commercial Centre

2-12 Queen’s Road West

Sheung Wan